ESG risks and opportunities: sovereign bond and credit ratings need to integrate sustainability:

Credit rating define the interest a country has to pay on loans, credits, state bonds, in short – on debt. Considering the level of state debts, the credit rating has a significant impact on the capital cost of nations.

The most important rating agencies are based on the “3 sisters” – Standard & Poor’s (S&P), Moody’s, and Fitch Group that together dominate the global market. Unfortunately, these ratings are based almost exclusively on economic, financial and political indicators, many of which are qualitative (i.e. cannot exclude subjectiveness). They are not fully reflecting the opportunities and risks associated with the fundamentals of the country; quality of education, infrastructure, social cohesion, and the environment. In addition, there have been accusation of political bias after ratings, in some cases, were adjusted following election and referenda outcomes

The Global Sustainable Competitiveness Index on the other hand is based on quantitative (i.e. subjective) indicators. It based on the fundamentals that define the outcome, including economic success.

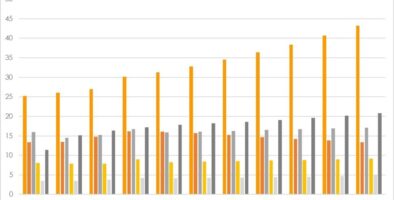

Current credit ratings and sustainable adjusted credit ratings for selected countries

The comparison between conventional sovereign bond ratings shows distinctive differences. Current sovereign ratings do not reflect real risks/opportunities. Credit ratings need to integrate sustainability.

Read more in the Sustainable vs Conventional Competitiveness Report: ESG Sovereign Bonds