Sustainability

Corporate Sustainability & ESG

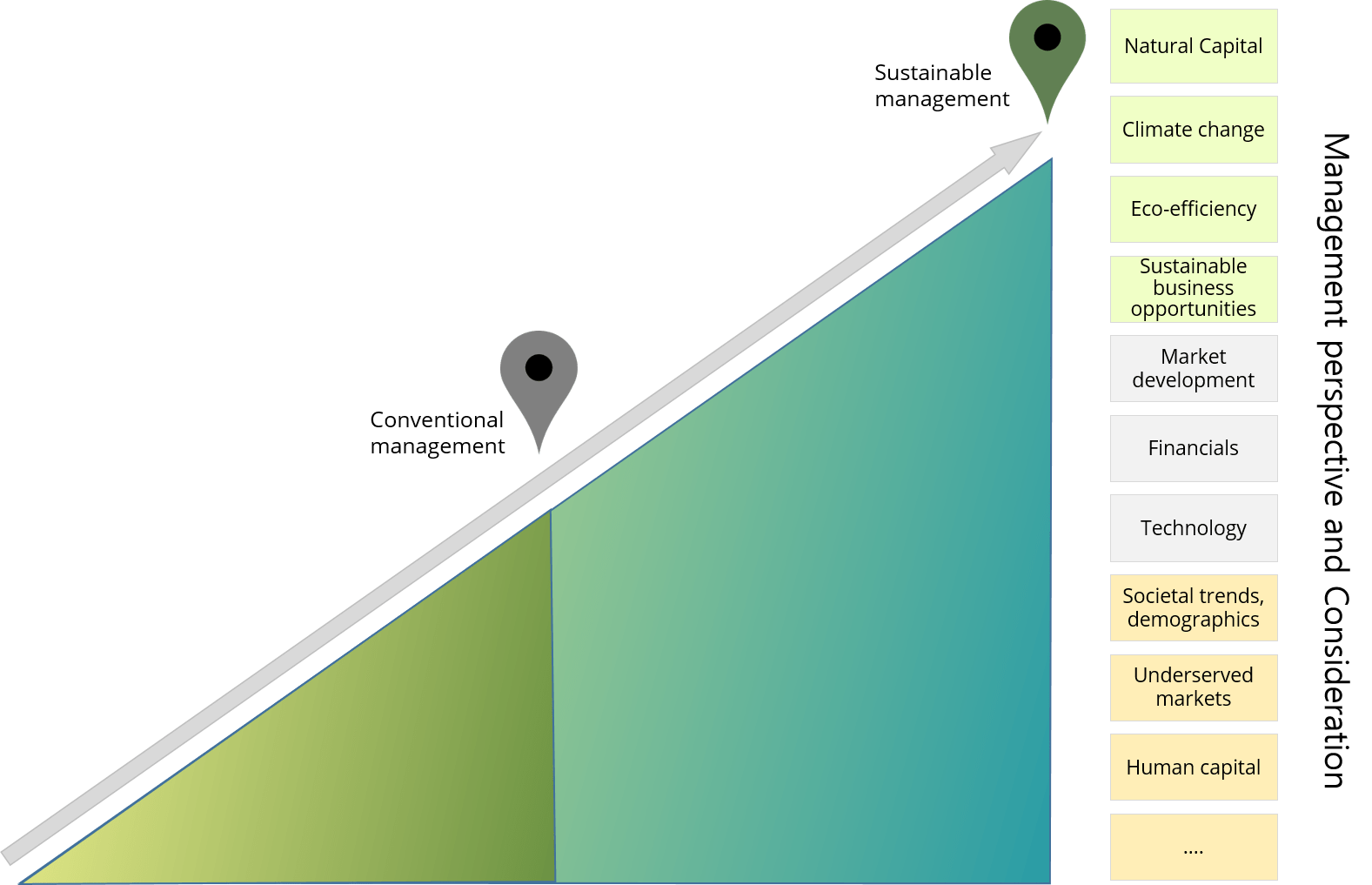

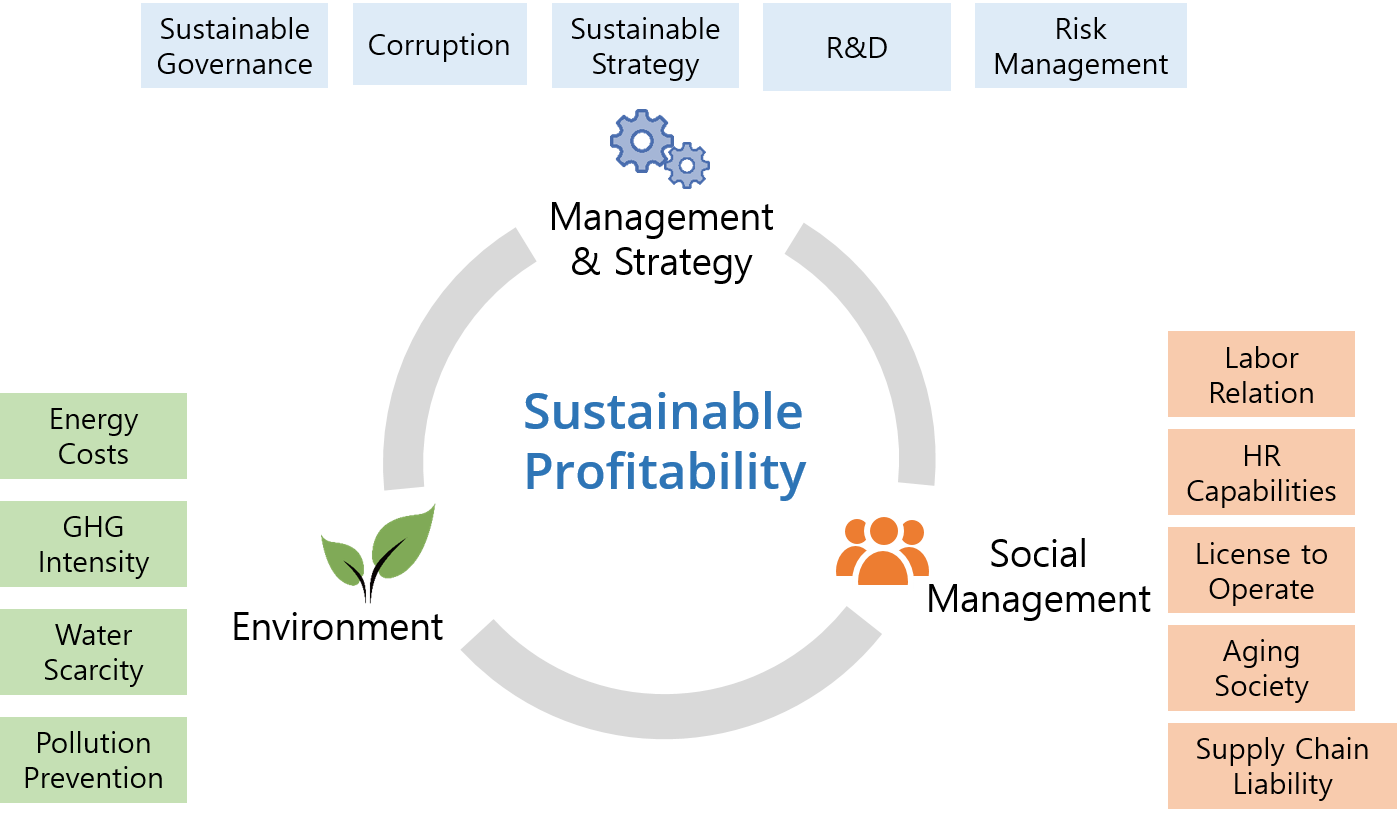

Corporate sustainability is the ability to fully integrate risks & opportunities associated with “non-financial” business themes into business management and decision making. Sustainable management means becoming and remaining successful in the fast-changing business environment.

A successful company is characterised by developing products or services that costumers want to buy, whilst controlling operational costs and managing risks and uncertainties. Embedded in a globalised and competitive business environment where economic, environmental and social issues are increasingly interwoven, businesses are facing challenges beyond classical financial and market indicators: companies need a new way of thinking – a better way of analysing management options.

Only when we are aware of all our options and their real-life consequences can we make informed decisions that sustain current value, and create new value.

In order to remain profitable, companies need to anticipate future trends and risks, both internal (in terms of operational management) and external (in terms of market, regulatory, and technology developments) – this is what sustainable competitiveness is about. Sustainable management means integrating all the “non-financial” factors that have indirect financial impacts. Sustainable management is not a revolution – it is a natural evolution of management approaches and paradigms in an increasingly complex business environment.

What is not competitive is not sustainable. What is not sustainable is not competitive.

Companies that fail to define timely business answers to the new challenges will face higher costs and lower customer acceptance, and may, in extreme cases, ultimately be forced out of business. Early adopters on the other hand can gain competitive advantage – in terms of cost structure, customer trust and product/service development.

With increasing influence and business impact of key sustainability trends – globalisation, climate change, energy and raw material scarcity, water constraints, ageing populations, etc. – the importance of sustainable management capabilities is set to increase further in the future.

Sustainable management is sustainable competitiveness. Managing sustainable means achieving competitive sustainability.

Competitive advantage: sustainable competitiveness = sustainable value creation

A coherent and fully integrated corporate sustainability strategy, based on a long-term approach, optimises the intangibles, offering bottom-line benefits and competitive advantages (sustainable competitiveness), while contributing to the well-being of the wider society and the environment.

A simple approach. Which requires sophisticated analysis.

For more information on sustainability implementation, please refer to SolAbility’s sustainability implementation guide “What gets measured gets done”

Sustainable competitiveness business drivers

- Minimising risks

Through pro-active management of sustainability issues and incorporation of non-technical and non-financial risk assessment as well as engaging in partnerships with diverse stakeholders, sustainable corporations are able to minimise business-related risks and future liability costs. - Innovation drive

Awareness for, and screening of non-financial risks and opportunities coupled with higher motivation of staff and open engagement with diverse stakeholders allows businesses to anticipate and set new trends, driving innovation. Sustainable corporations gain competitive edge through the capability of capitalising on new trends, and turning challenges into opportunities. - Reducing operational costs

Increased eco-efficiency directly translates into lower operating costs (lower energy bills, raw material costs, reduction of hazardous waste disposal costs, recycling, etc.). In addition, enhancing life-cycle assessment and optimisation of processes lowers costs of adapting to future tightening environmental legislation. - Improved workforce motivation

A coherent sustainability strategy enhances identification of staff with the company, thus increasing workforce motivation and satisfaction, which in turn is positively linked to customer satisfaction. - Access to talent

Organisations known for adapting sustainability practices into their business operations are preferred employers for talented professionals. In addition, a coherent sustainability strategy enhances identification of staff with the company, thus increasing workforce motivation. - Higher brand value, improved reputation and corporate identity

Systematic management of non-financial issues distinguishes the brand value and helps to improve the corporate reputation with customers, consumers and other influential stakeholders, thus strengthening the market position of a company. - Improving financial creditability and access to capital

Investment decisions, project-specific lending and calculation of insurance premiums are increasingly subjected to sustainability assessment. A coherent corporate sustainability strategy, sustainability risk assessment and transparent reporting increases the creditability with financial institutions and insurance companies, enhancing access to capital and lowering capital costs. - Increasing investor confidence

Analysts are increasingly looking at non-financial risks of companies, and sustainability issues have become a part of mainstream investor assessment methodologies in Europe and North America. Transparency and a solid strategy focusing on value creation including environmental and social indicators, is helping to enhance investor confidence. - Enhanced stakeholder relations

Systematic stakeholder engagement, including with host communities and civic groups (e.g. NGOs), is the best guarantee to retain the “license to operate” through minimising potential for conflicts, ultimately leading to reduced costs through faster project approval and delivery. Moreover, stakeholder engagement reduces the potential for consumer boycotts and serves as a tool to identify future business opportunities. - Implications for investors

Processes and systems that are capable to identify true (not perceived, or reported) sustainable value and management capabilities allows investors to achieve outstanding investment returns.

Regulatory leadership

We are observing highly controversial disputes over the direction forward in the regulatory & legislative fields (governance) across the globe. There are strong controversies on what are the best ways forwards facing the current challenges. In short, and strongly simplified, there are those who believe the free market – which gives, whether intended or not, great powers to the powerful players, i.e. the free, global financial market – is the best regulator and should therefore be allowed to influence most regulations. And then there are others, who believe legislative and regulations should influence the outcome and distribution of generated wealth, and should preserve natural capital, but, in face of the complexity of today’s World, as of yet lack a coherent strategy that would appeal as workable.

In other words: current policies are marred by ideologies (i.e. emotional valuation), rather than analytical evaluation. Sustainable governance is about being pragmatic. Policy options are explored and analysed regardless of the ideological background and conformity; may that be “liberal”, “free-market-driven”, “left”, “right”, or “social”. Policy options are explored purely based on their potential and possible outcomes in order to come to the most promising options. Sustainable competitiveness through governance means regulatory and policy decisions have to facilitate the development and sustained income generation of individuals, communities, and economic entities in their wider environment for current and future generations.