ESG

ESG / Sustainable Investment

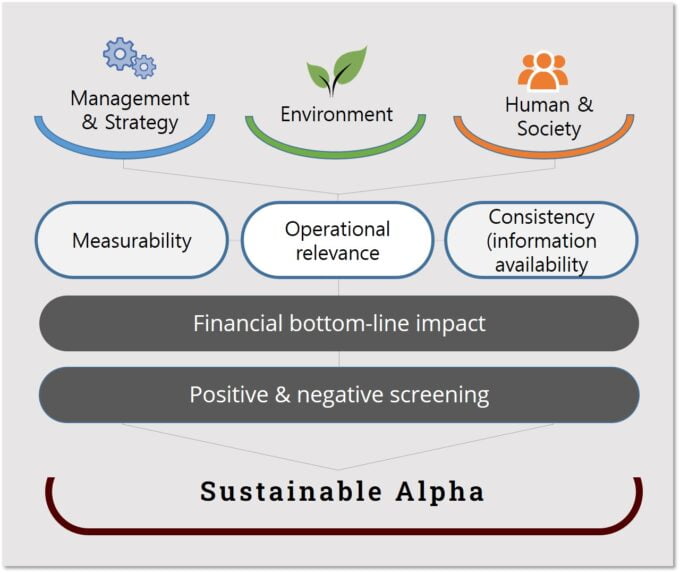

Materiality and measurability

SolAbility has been active in ESG research provision for institutional investors. We have developed our own methodology. Fund managed based on SolAbility’s ESG research have outperformed all ESG and non-ESG benchmarks. Success requires a rigorous approach to develop methodologies that can identify sustainable value. Methodologies and integration therefore need to focus equally on materiality, relevance, and measurability.

What is sustainable investment?

Sustainable investment, just like sustainable management, has many flavours, and can mean different things to different people. The basic notion is that companies that are able to manage all their risks (i.e. including sustainability risks) have a competitive edge against their peers and therefore a higher chance of sustained business success in terms of sales and profitability. By identifying those sustainable companies, and investing in their shares (or bonds), it is expected to achieve a higher financial return – both in terms of share price development and dividends. There are two 3 investment philosophies commonly associated with sustainable investment:

- Value-based investment (often referred to as SRI, socially responsible investment or RI, responsible investment). SRI is value based and most often applies exclusion criteria such as themes based exclusions (e.g. arms, tobacco, alcohol, pornography) or issue-based exclusion (excluding companies with a negative human rights or environmental track record. SRI is the oldest form of sustainable investment, but has remained a niche investment strategy.

- Sustainable investment (also referred to as ESG – environment, social, governance – investment). Sustainable investment is based on identification of sustainable investment opportunities, i.e. identification of companies that are more sustainable than their peers through a best-in-class approach. ESG research now influences investment processes in a significant number of investments; but the extent of the integration into conventional financial analysis remains limited in most cases.

- Themes-based investment: investment in companies or projects that capitalise on the sustainability challenges, trough thematic investment e.g. in renewable energy, water (water treatment, efficiency, distribution), health, financial inclusion (microfinance). “Clean-Tech investment” has experienced somewhat of a bubble, with low investment returns due to over-exposure in the solar PV industry that collapsed due to global overcapacities as a consequence of miss-directed subsidies.

Refer to SolAbility’s ESG publications for further information.

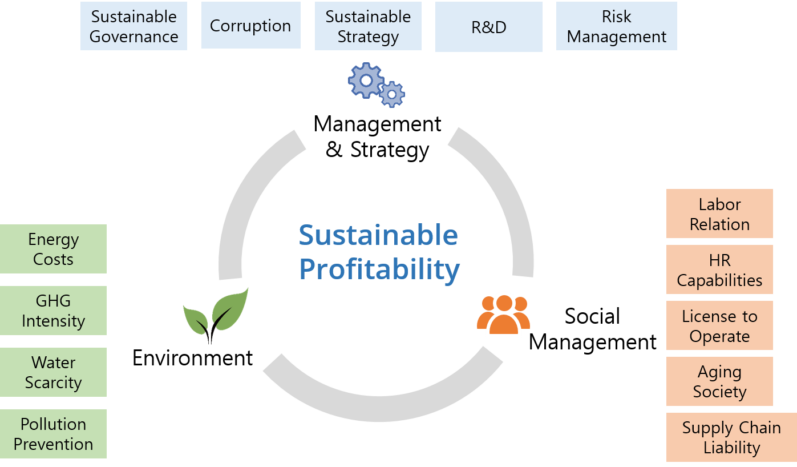

ESG and non-ESG issues (not industry specific in this example) that decide over the future performance of a company

Sustainable invstment research to identify superior invstment return

Sustainable investment & financial performance

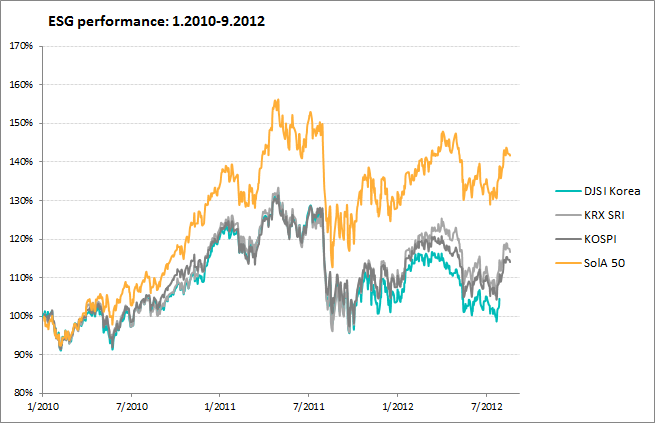

A research process that is capable to identify true (not perceived, or reported) sustainable value and management capabilities allows investors to achieve outstanding investment returns. . The performance graph of SolAbility’s SolA 50 Index of Korean equities (Koreas 50 most sustainable listed companies) is based on sustainable performance, complete neglecting of any corporate financial indicators. Nevertheless, the Index has outperformed the market indices each year since 2007, both in upwards and downward trends, sometimes at significant margins.

However, sustainable investment (all of the three categories above) is no automatic guarantee to higher investment returns – it can, if applied properly, lead to higher returns. Meta-studies of SRI/ESG funds show mostly neutral return compared to conventional funds, with broker research suggesting slightly higher positive performance compared to academic research.

SolA 50 outperformed both the market and other sustainability indexes in Korea for 6 consecutive years

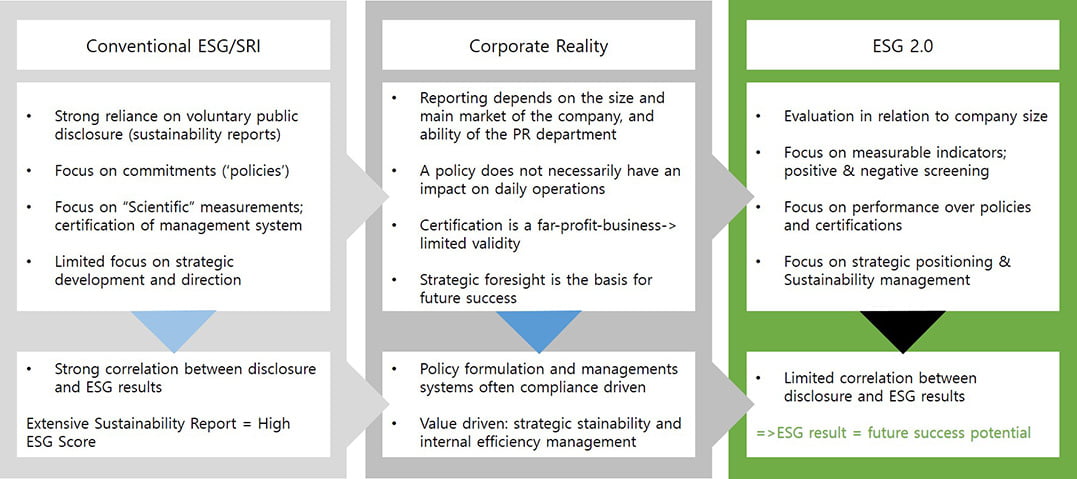

The importance of methodologies & processes

Like everything else in this world, the outcome depends on the quality. In the case of sustainable investment, the outcome (return) depends on a) the quality of the research and b) application of the research in the investment; both of which are key to capitalise on the superior performance of sustainably managed companies and projects. The reason many SRI/ESG funds are unable to capitalise on sustainability trends include

- Insufficient research quality. Reporting on sustainability, having formulated policies in place, and external certification of management system has become mainstream within large corporations. Differentiating between the real sustainable corporations and companies that have some policies in place to satisfy the public and/or regulatory requirements therefore has become more difficult. Identification of true sustainable investment value therefore requires a new approach to SRI/ESG performance evaluation that is based on performance rather than policies and external communication

- Lack of integration in the investment process. Financial analysis is based on financial numbers, where ESG research is based on non-financial numbers. Fund managers tend to base their investment decisions on “fair value” calculations or similar financial metrics. The extent of ESG/SRI integration into the calculation or forecasting of corporate financial performance is decisive for the return of the fund.

- Fund management practices. It is the nature of funds that they want to take the profit of an investment – and then re-invest the profit in different equities they believe will increase in value. In other words – even ESG/SRI funds are often managed based on short-termism, which is contrary to the notion of sustainable investment. Unfortunately, research on the impact of equity turnover on fund performance is hard to come by. However, sustainable investment is investment based on long-term business returns, and evidence suggests that long-term investment outperforms funds that are based on frequent turn-over based on short-term market fluctuations.

Sustainable investment does not necessarily yield higher investment returns outperforming the market – but it will if applied correctly in research and integration.

With increasing influence and business impact of key sustainability trends – climate change, energy and raw material scarcity, water constraints, aging populations, etc. the importance of sustainable business management capabilities is set to increase further in the future, and thus the opportunities and returns of sustainable investment.

Please refer to SolAbility’s ESG publications for further information.