The Gulf Countries: Ready For The Energy Transition?

The Gulf countries have the resources and capabilities to thrive without oil income

The Gulf countries currently generate between 15 and 40% of their GDP and close to 100% of government revenues from oil & gas. However – renewables and everything electric are now much cheaper than burning fossils. Demand for oil will drastically decline after 2030 – oil-exporting countries must replace the fossil income, the sooner the better. But how?

- Gulf cooperation countries – Saudi Arabia, the United Arab Emirates, Qatar, Kuwait currently generate between 15 and 40% of their GDP and close to 100% of government revenues from fossil exploitation

- The markets for renewables and electricity-powered consumption have reached momentum that is now unstoppable. It’s simple economics: Renewables are – by a large margin – more efficient and cheaper.

- As a consequence, fossils and fossil-powered consumption are no longer competitive. Demand for oil will peak between 2025 and 2027, and thereafter start to decline, slowly at first, and faster over time. Demand, revenues and profits for and from fossils will decline in accordance.

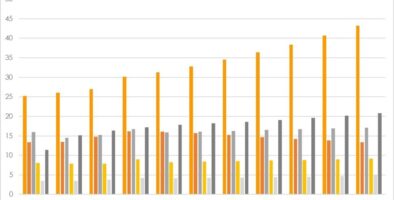

Data source: World Bank

Fossil rent of Gulf area countries as % of GDP

Data source: IRENA, IEA

Development of renewable investments

Data source: IEA, BP, SolAbility

Future oil demand

- Fossil income in the Gulf countries is set to drastically decline after 2030 (at the latest), and might well be close to zero by 2040

- Diversification efforts so far have resulted in the development of alternative income streams, (hub functions, service centres, tourism, hospitality). The UAE and Qatar are quite advanced in diversification, with Saudi Arabia and Kuwait having made somewhat less progress in reducing dependency on fossil income

- The transition to renewables is set to happen faster than previously anticipated. GCC countries therefore have to revise their development visions, and investment plans to accelerate their own transition.

- Thanks to the financial resources (sovereign wealth funds) and past investments in new business areas, infrastructure, education and health, GCC countries are in a reasonable position to successfully manage a transition to advanced economies without fossil income.

However, circumstances and the pace of development require acceleration of current efforts to diversify the GCC economies if decline of living standards are to be avoided. Resources and investments need to be allocated wisely in areas that promise the highest return on investment in terms of sustainable competitiveness.

Download the full report: How to replace fossil income in the Gulf countries

(PDF, 38 pages)