Global carbon removal with hemp biochar

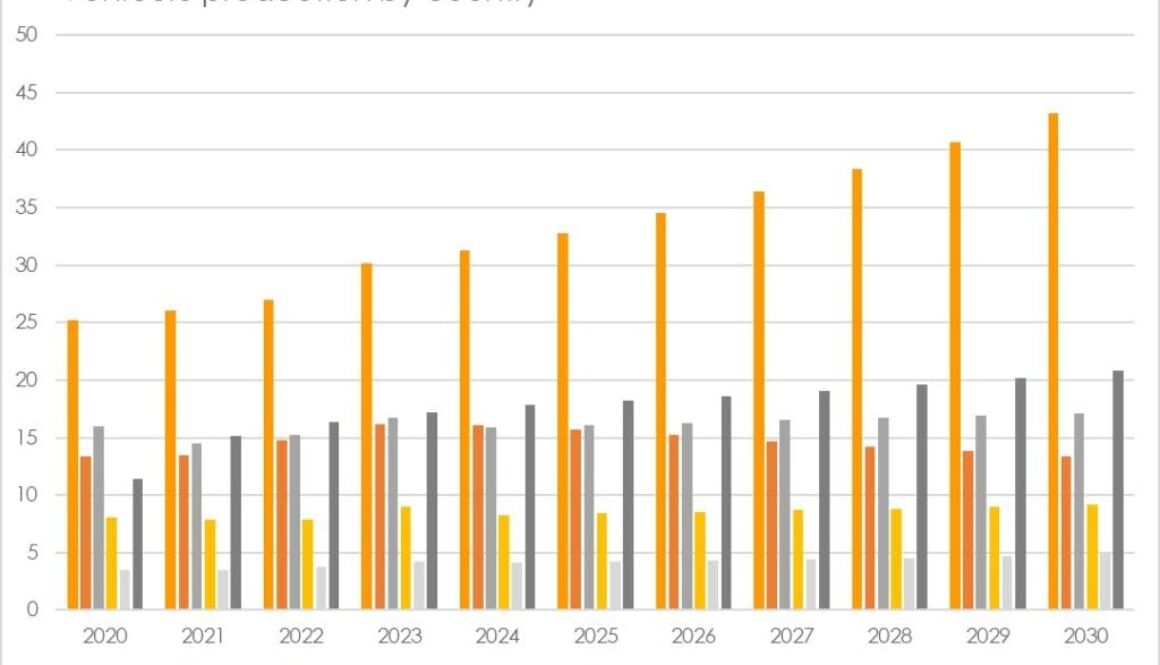

Large-scale CO2 removal with hemp-based bio-char: Creating 100 million jobs. Removing 10 gigatonnes of CO2 from the atmosphere (30% of 2025 global emissions). Five years pay-back.

Large-scale CO2 removal with hemp-based bio-char: Creating 100 million jobs. Removing 10 gigatonnes of CO2 from the atmosphere (30% of 2025 global emissions). Five years pay-back.

The next five years will determine which car companies successfully navigate the electric transition and which companies become casualties of technological and market disruption.

Using a mixture of conventional statistical economic and deep-learning AI tools, we have built a forecasting model using historical car industry performance and production data, combined with brand power and consumer perceptions, model-line ups, and speed of adaption to identify winners and losers.

The Global Sustainable Competitveness Index 2024 Measuring competitiveness First published in 2012, the Global Sustainable Competitiveness Index (GSCI) measures country-level ESG performance based on 216 quantitative indicators, using, amongst others, deep-learning AI-tools to analyse data correlations, trends, and for forecasting. The GSCI serves as inclusive alternative to the GDP, to assess country-specific and issue-specific risks […]

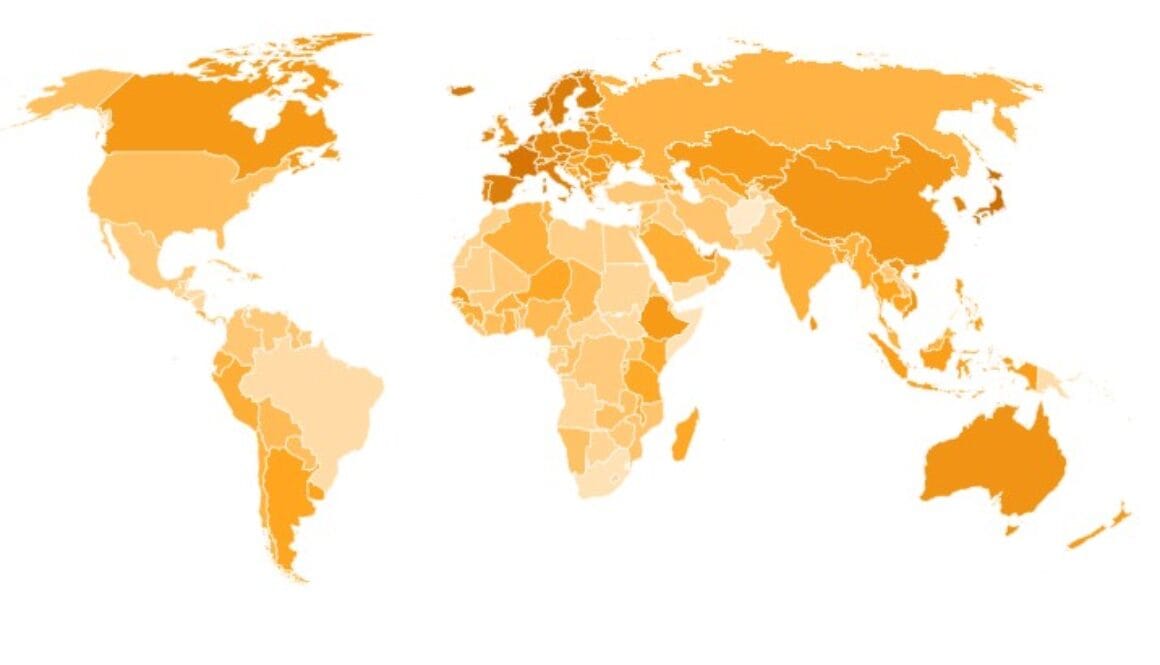

Governance defines the environment the society – individual and businesses – operate in. The Governance Index of the Global Sustainable Competitiveness Index therefore evaluates the outcomes of regulatory frameworks and infrastructure—not government systems or policies themselves. It assesses how well a country’s governance enables natural, social, and intellectual capital to thrive sustainably.Global Governance Performance 2024

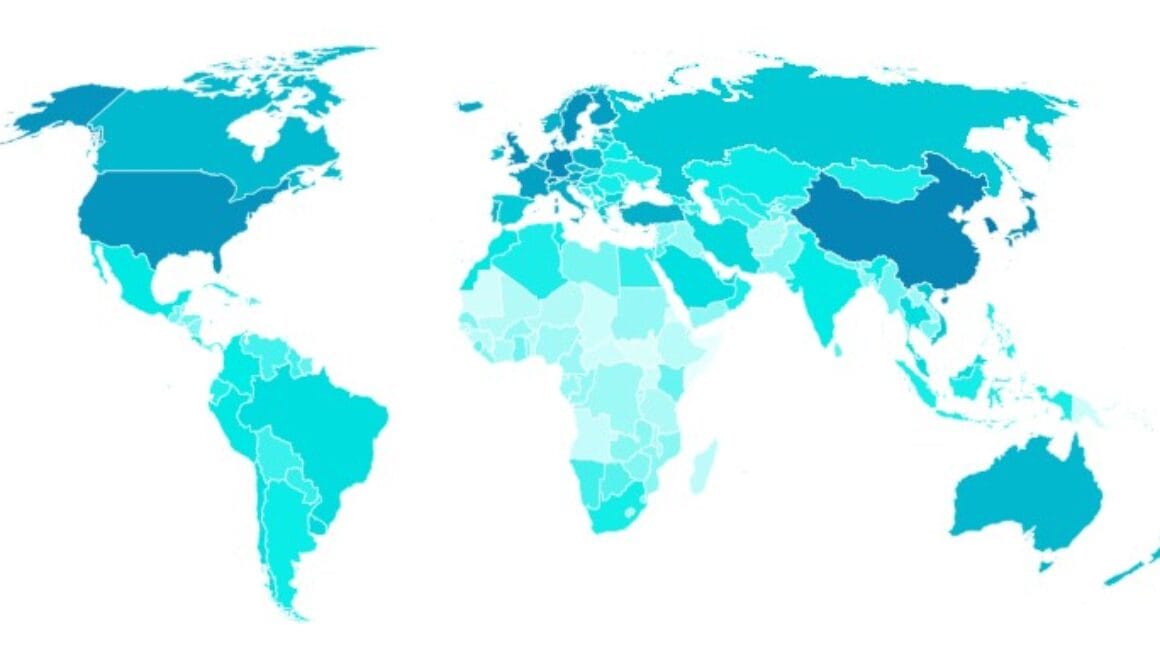

The Social Capital Index 2024 is dominated by Scandinavian Nations. Social Capital fosters social cohesion and consensus, creating a stable environment for economic growth while reducing the over-exploitation of natural resources. Social Capital is influenced by factors such as healthcare availability and affordability, income and asset equality (linked to crime levels), demographic structure, freedom of expression, freedom from fear, and the absence of violent conflict

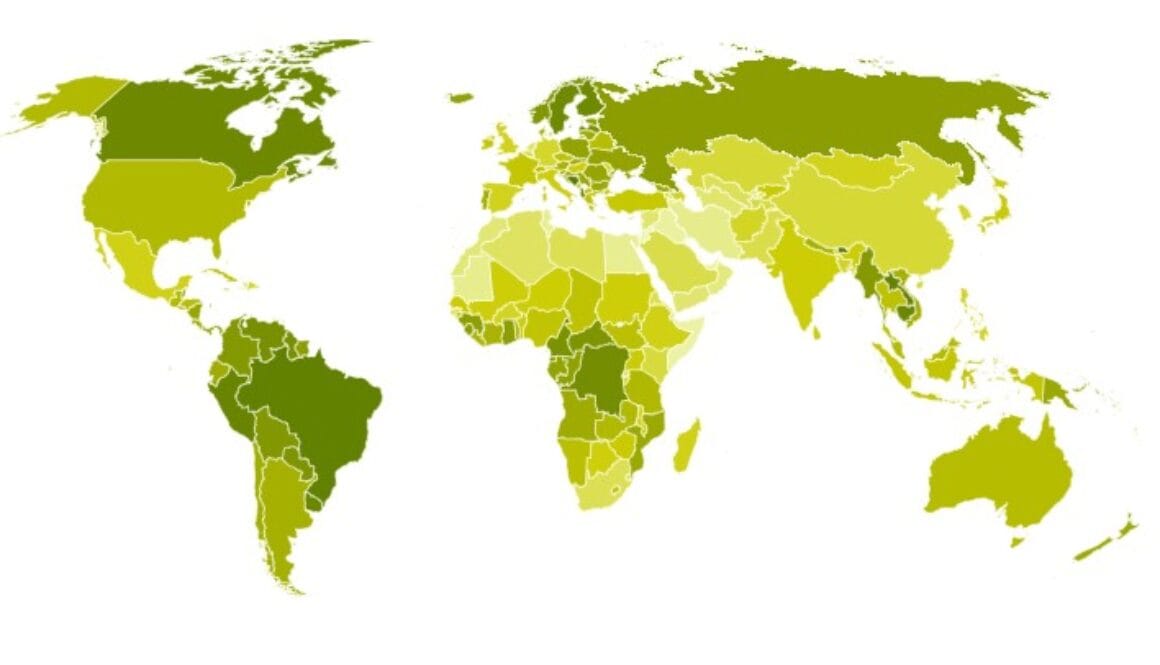

The quality and availability of education in the past are strong predictors of current R&D and innovation capacities, while today’s educational performance shapes future innovation potential. Robust and extensive R&D activities form the foundation for developing value-added technologies and services. Consequently, educational performance indicators are critical for assessing a nation’s long-term ability to sustain innovation […]

The Natural Capital reflects “the given” natural environment of a country, and the state of its health/decline of that Natural Capital, measured through 38 quantitative indicators covering all aspects of natural resources. High-ranking countries are characterised by abundant water availability, the source of a rich biodiversity. Many of the highest scoring countries are located in […]

Fossil Fuels Are No Longer CompetitiveRenewable electricity is now the cheapest form of energy, and electric vehicles and heating cheaper than fossil. Demand for fossils is to peak in 2025, and drastically decline after 2030.Controlling fire is what distinguished humans from other species. It allowed us to survive and thrive in colder climate. Making a […]

How to become sustainable and competitive: key policies to achieve sustainable competitiveness throughout all dimensions of a country

The Gulf Countries: Ready For The Energy Transition? The Gulf countries have the resources and capabilities to thrive without oil income The Gulf countries currently generate between 15 and 40% of their GDP and close to 100% of government revenues from oil & gas. However – renewables and everything electric are now much cheaper than […]