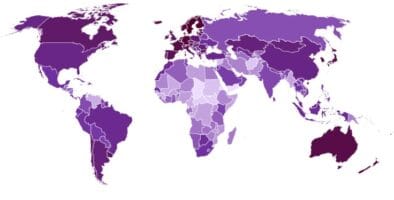

The Global Sustainable Competitiveness Index 2019

The Global Sustainable Competitiveness Index measures country performance based on an integrated competitiveness model. It is calculated through 116 quantitative indicators across all aspects that form the foundation for success: Natural Capital, Resource Intensity, Intellectual Capital, Social Cohesion, and Governance.

Key takeaways in 2019 include:

- The top 5 spots are occupied by Scandinavia: Sweden is leading the Sustainable Competitiveness Index, followed by the other 4 Scandinavian nations and Switzerland.

- Of the top twenty nations only two are not European – New Zealand on 12, and Canada on 19.

- Germany ranks 15, the UK 17, Japan 25, South Korea 27

- The World’s largest economy, the US, is ranked 34. The US ranks particularly low in resource efficiency and social capital – potentially undermining the global status of the US in the future

- Of the large emerging economies (BRICs), China is ranked 37, Brazil 49, Russia 51, and India 130.

- Some of the least developed nations have a considerable higher GSCI ranking than their GDP would suggest (e.g. Laos, Timor, Burma, Bhutan, Suriname…)

- Asian nations (South Korea, Japan, Singapore, and China) lead the Intellectual Capital ranking. However, achieving sustained prosperity in these countries might be compromised by Natural Capital constraints and current high resource intensity/low resource efficiency

Download the report (PDF) Global Sustainable Competitiveness Index 2019

Download the press release Press Release GSCI 2019

US, resource-dependent countries’ sovereign ratings should be downgraded, others up

Sovereign bond ratings are overly based on financial indicators and perceived political intentions. They do not reflect investor risks at this point in time.

The US, for example, should be downgraded by 2 levels, Saudi Arabia by 4, while Kenya and Bolivia should be rated higher in line with their sustainable competitiveness performance. A complete list of comparisons of sustainable vs. conventional bond ratings is available here.