Climate taxes on GHGs with cash-back to accelerate the energy transition

Economically beneficial. Socially just. Efficient. The road to zero carbon emissions: Global Climate Fees & Cash-Back.

Droughts, heat waves, wild fires, freak storms, flooding, land-slides, water scarcity. Climate Change is here. Yet -wherever one looks: no plan. Targets and pledges, but no tools and plans.

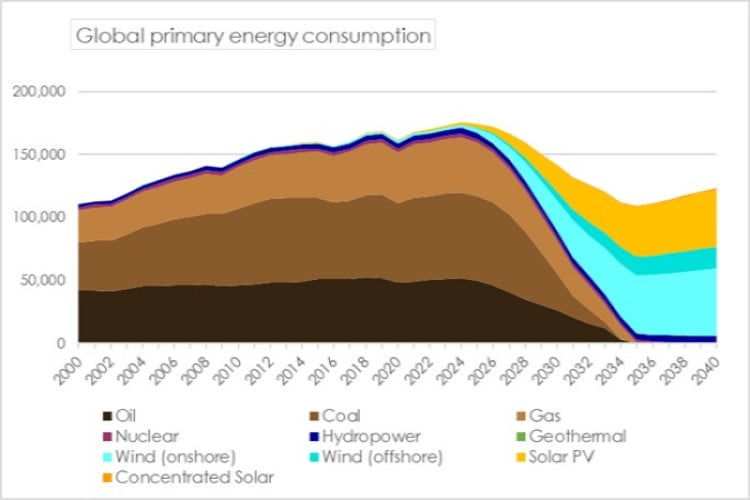

Not only do we already have all the technology, the new technology is also more efficient and cheaper than fossil technology.

We also have simple economic tools to accelerate the markets and financing transition: taxing fossils.

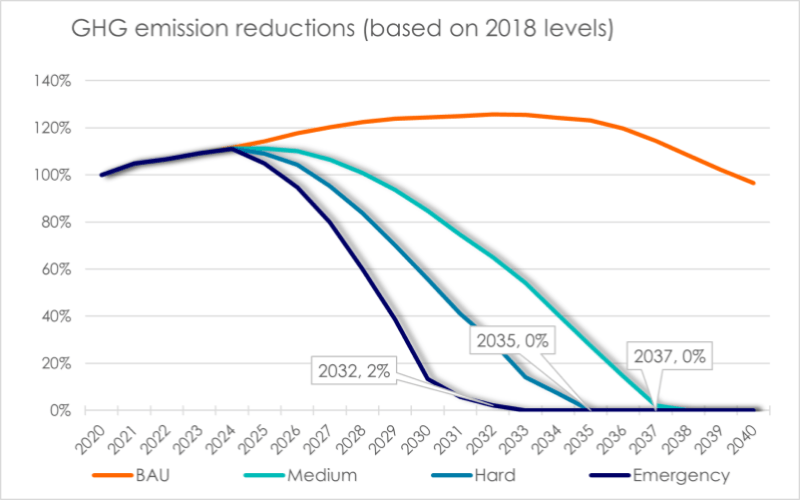

Zero Emissions by 2035

If the World were to

- Tax oil/gas/coal, everywhere, at the same rate, (U$ 100/tCO2, increasing by U$ 100 every year)

- Re-distribute 50% of that tax revenues per capita in cash to the people

- Re-invest 50% in building renewable infrastructure (generation, distribution, storage, end-user systems)

We would have an excellent economy, and renewables enough to replace all fossils by 2035 (at the latest).

Millions of jobs. Lower energy costs, no more climate emissions. Less pollution, better health.

While we know what we need – a rapid transition to a fossil-free infrastructure, the inaction in the face of simple physics is deafening. It is too expensive; it is technologically not possible. Not true.

International negotiations so far unfortunately have failed to produce any measurable action – and there is reason to believe that will not change soon enough. Emission reduction targets & pledges, every country on its own, no international co-ordination of incentives and policies, or financing. No roadmaps with timelines and resources allocated. Global emissions are still rising.

While it might be politically illusionary, the simplest to achieve a fast transition to a non-fossil society with a renewable infrastructure is Global Climate Tax’n’Cash’:

ClimaTax, step by step

- A climate tax on all fuels and GHG-active fuels and substances

- The climate tax is levied on the price at the point of sale to the end consumer, administrated like a VAT: Climate Added Tax, CAT.

- The tax is levied at the same rate, everywhere around the globe.

- The climate tax shall be increased every year to allow the economy to adapt, step by step. The suggested starting tax is U$100 per ton of CO2 equivalent, increasing by U$100 every year

- The tax revenues are 50% re-distributed to the people in cash (ideally, the low-income groups will receive a higher cash-back than high-incomers),

- 40% of the CAT revenues are invested in renewable energy infrastructure, public transport, and replacment of fossil vehicules and heating systems

- 7% of the CAT revenues for re-forestation and mitigation,

- 1% of the CAT revenues are invested in education and R&D,

- and 3% as compensation for damages incurred and climate mitigation in support of the most affected and least developed nations.

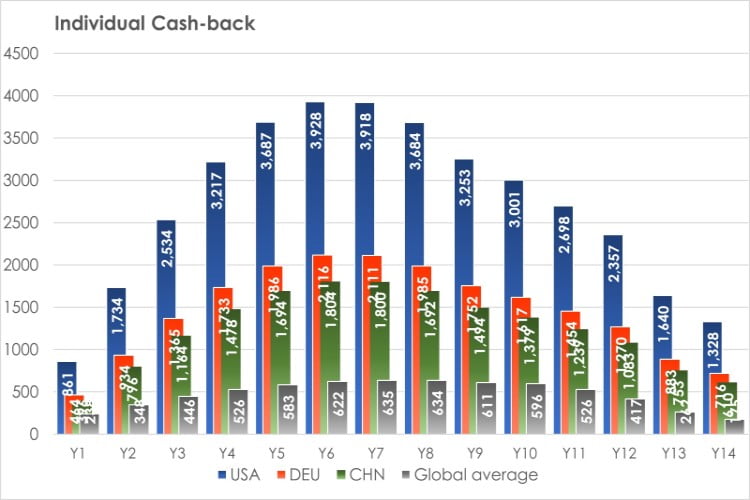

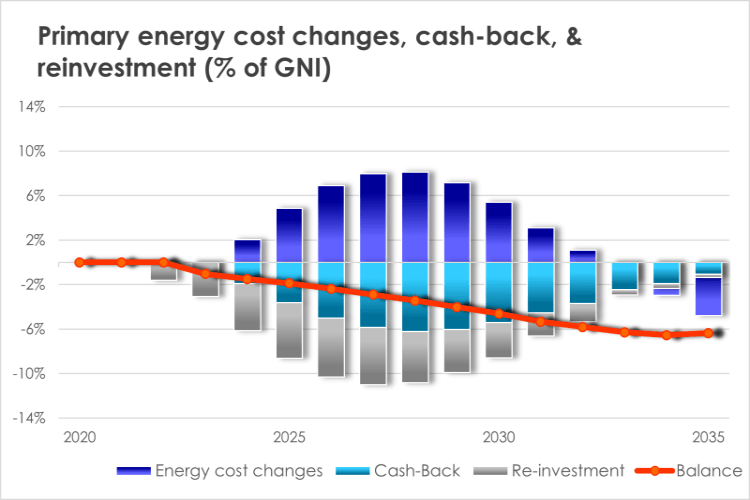

We already have the key technologies in place, highly competitive at the market. While a CAT will initially increase energy bills, the cash-back will compensate for the lower-income groups, more than 50% of the population will have more money on their hands than before. The tax will make fossil energy more expensive while renewables become cheaper, accelerating the transformation, stimulating investments in R&D, speeding up technological development and cost reductions.

Win-win all around

According to the Climate Tax’n’Cash simulation, we will have

- Zero carbon emissions: Sufficient renewable energy available to replace all fossil fuels by 2035 at the latest = zero energy emissions

Lower energy cost: Thanks to higher efficiency and lower fuel cost, the global energy bill will be 30-50% lower than today

- Thriving economy: thanks to re-distribution and re-investment of all fossil tax revenues, the economy is stimulated, not disrupted

- Better health: less burning fossil, less pollution, better health

ClimaTax’n’Cash: CO2 emissions and energy mix

Given a climate tax as proposed above, CO2 emissions would be completly eliminated by 2035.

Taking market dynamics indiced by a fossil tax into account, the zero emission might well be achieved earlier.

The energy mix transformation from fossils to renewable with fossil tax and climate cash

ClimaTax’n’Cash- economic impacts

The cash-back each individual receives from ClimaTax’n’Cash (the individual ammount is different from country to country, because the tax is levied and re-distributed at the national level).

Individual energy consumption is directly tied to income. Between 60% and 70% of the population would have more disposable income at their hands during the transition, evene after accounting for incresaing energy cost.

All tax revenues are diectly re-invested into the economy. While energy cost increase at the beginniing of the transition, they are moe than offset by the investments in renewables and individual cash-back.

ClimaTax’n’Cash has net positive effects on the economy from year one – and lead to a reduction of the global energy bill by 50%.

For more information, download the reports or visit Global Climate Tax

Executive summary of the ClimaTax’n’Cash simulation, based on data up to 2022

Changing Climate Change: Global Climate Tax

Note: this Report was first published in 2019; it is based on data up to 2018