ESG

Country

Credit

Ratings

ESG Credit Rating & Sovereign Bonds

ESG-adjusted country ratings better reflect investor risks & opportunities

Sovereign risk ratings –commonly referred to as credit rating – determines the level of interest a country has to pay for loans and credits. It is therefore a very important parameter for every economy – it defines the level of capital cost for new investments, whatever the nature of those investment may be. Credit ratings also affect direct investment decisions.

Sovereign risk ratings are calculated by a number of rating agencies, most notable (and defining) by the “three sisters”: Moody’s S&P, and Fitch. The publications and ratings of these three companies therefore have a significant impact on the cost of capital of a specific country.

Conventional credit ratings are calculated based on a mix of economic, political and financial risks – mainly current risks. However, current risks – like GDP – do not reflect the framework that creates the current situation. Current rating methodologies fail to integrate the wider environment – the ability and motivation of the workforce, the health and well-being of the population, the physical environment (natural and man-made) that have caused the current situation. It is therefore questionable whether credit ratings truly reflect investor risks of investing in a specific country.

For a detailed analysis, download the ESG Sovereign Bond Report.

ESG credit ratings vs. conventional ratings

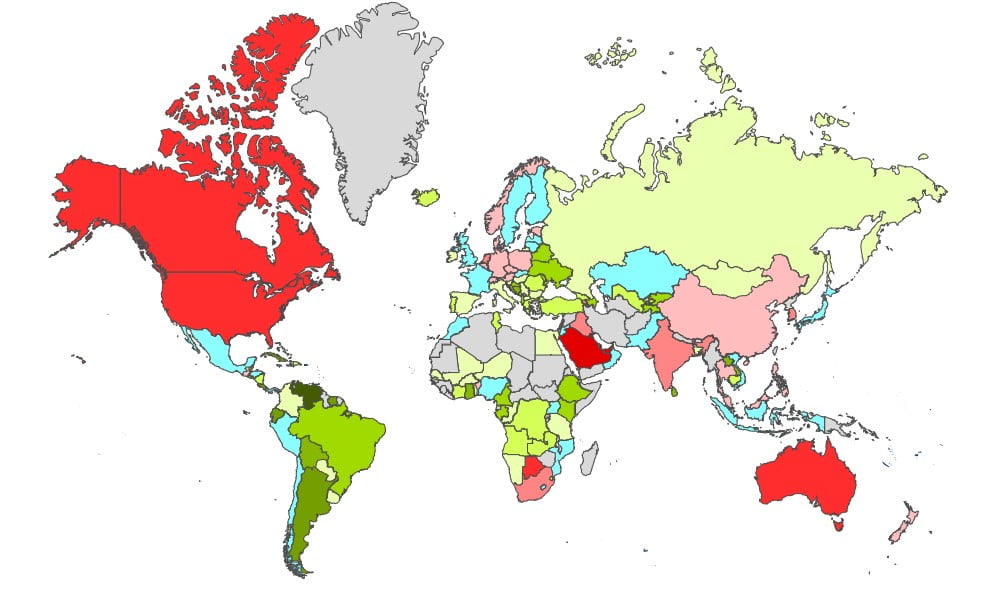

ESG Ratings vs currently used country credit ratings:

ESG Sovereign Bond Rating by Country

| Country | Current Credit Rating Average Moody's, S&P, Fitch | GSCI ESG Rating | ESG vs. Current Rating | ESG-Adjusted Rating | ESG-Adjusted vs. Current Rating |

|---|---|---|---|---|---|

| Albania | B+ | BBB+ | 6 | BB+ | 3 |

| Andorra | BBB+ | BBB | -1 | BBB | -1 |

| Angola | CCC+ | B+ | 3 | B | 2 |

| Argentina | CCC | BBB+ | 10 | BB− | 5 |

| Armenia | B+ | BBB | 5 | BB+ | 3 |

| Aruba | BBB− | CCC− | -9 | B | -5 |

| Australia | AAA | BBB+ | -7 | AA− | -3 |

| Austria | AA+ | AA− | -2 | AA | -1 |

| Azerbaijan | BB+ | B+ | -3 | BB− | -2 |

| Bahamas | BB− | B− | -3 | B | -2 |

| Bahrain | B+ | CCC+ | -3 | B− | -2 |

| Bangladesh | BB− | BB | 1 | BB | 1 |

| Barbados | CCC+ | B | 2 | B− | 1 |

| Belarus | B | BBB+ | 7 | BB | 3 |

| Belgium | AA− | A | -2 | A+ | -1 |

| Belize | CCC− | BBB | 10 | B+ | 5 |

| Benin | B+ | B− | -2 | B | -1 |

| Bolivia | B | BBB+ | 7 | BB+ | 4 |

| Bosnia and Herzegovina | B | BBB | 7 | BB | 4 |

| Botswana | A− | BB | -5 | BBB− | -3 |

| Brazil | BB | BBB+ | 5 | BBB− | 3 |

| Bulgaria | BBB | BBB+ | 1 | BBB+ | 1 |

| Burkina Faso | B | BB− | 2 | B+ | 1 |

| Cambodia | B | BB | 3 | BB− | 2 |

| Cameroon | B | BBB− | 5 | BB | 3 |

| Canada | AAA | A− | -6 | AA− | -3 |

| Cape Verde | B− | B− | 0 | B− | 0 |

| Chile | A | A− | -1 | A | 0 |

| China | A+ | A− | -2 | A | -1 |

| Colombia | BBB− | BBB+ | 2 | BBB | 1 |

| Congo | CCC+ | BB− | 4 | B | 2 |

| Costa Rica | B | A | 9 | BBB− | 5 |

| Croatia | BBB− | A+ | 5 | A− | 3 |

| Cuba | CC | BB+ | 9 | B | 5 |

| Cyprus | BBB− | BBB | 2 | BBB− | 1 |

| Czech Republic | AA− | A | -2 | A+ | -1 |

| Denmark | AAA | AA | -2 | AA+ | -1 |

| Dominican Republic | BB− | BBB− | 3 | BB+ | 2 |

| Ecuador | CCC+ | BBB+ | 10 | BB− | 5 |

| Egypt | B | B+ | 1 | B+ | 1 |

| El Salvador | B− | BBB− | 7 | BB− | 4 |

| Estonia | AA− | A+ | -1 | A+ | -1 |

| Ethiopia | CCC | BB | 6 | B | 3 |

| Fiji | B+ | BBB | 5 | BB+ | 3 |

| Finland | AA+ | AA+ | 0 | AA+ | 0 |

| France | AA | AA− | -1 | AA | 0 |

| Gabon | B− | BB | 5 | B+ | 3 |

| Georgia | BB | BBB+ | 4 | BBB− | 2 |

| Germany | AAA | AA− | -3 | AA+ | -1 |

| Ghana | B | BBB | 7 | BB | 4 |

| Greece | BB | BBB+ | 4 | BBB− | 2 |

| Guatemala | BB | B | -3 | BB− | -1 |

| Honduras | B+ | B | -1 | B+ | 0 |

| Hong Kong | AA | BBB | -6 | A | -3 |

| Hungary | BBB | A− | 2 | BBB+ | 1 |

| Iceland | A | AA | 3 | AA− | 2 |

| India | BBB− | B+ | -4 | BB | -2 |

| Indonesia | BBB | BBB | 0 | BBB | 0 |

| Iraq | B− | CC | -4 | CCC | -2 |

| Ireland | A+ | AA− | 2 | A+ | 1 |

| Isle of Man | AA− | BBB | -5 | A | -2 |

| Israel | A+ | BBB | -4 | A− | -2 |

| Italy | BBB | A− | 2 | BBB+ | 1 |

| Ivory Coast | BB− | BBB− | 3 | BB+ | 2 |

| Jamaica | B+ | BB− | 1 | B+ | 0 |

| Japan | A+ | A+ | 0 | A+ | 0 |

| Jordan | B+ | B+ | 0 | B+ | 0 |

| Kazakhstan | BBB | BBB− | -1 | BBB | 0 |

| Kenya | B | BBB− | 5 | BB | 3 |

| Kuwait | AA− | B | -11 | BBB− | -6 |

| Kyrgyzstan | B | BBB | 6 | BB | 3 |

| Laos | CCC+ | BB+ | 7 | B+ | 4 |

| Latvia | A | A | 0 | A | 0 |

| Lebanon | D | CCC | 4 | CC | 2 |

| Lesotho | B | B− | -1 | B | 0 |

| Liechtenstein | AAA | A+ | -4 | AA | -2 |

| Lithuania | A | A | 0 | A | 0 |

| Macedonia | BB+ | BBB | 2 | BBB− | 1 |

| Malaysia | A− | BBB | -2 | BBB+ | -1 |

| Maldives | B− | BBB− | 7 | BB− | 4 |

| Mali | CCC+ | B− | 1 | B− | 1 |

| Malta | A+ | A− | -2 | A | -1 |

| Mauritius | BBB | BBB+ | 1 | BBB+ | 1 |

| Mexico | BBB | BBB− | -1 | BBB | 0 |

| Moldova | B− | BBB− | 6 | BB− | 3 |

| Mongolia | B | BB− | 2 | B+ | 1 |

| Montenegro | B+ | BBB | 6 | BB | 3 |

| Morocco | BB+ | BB+ | 0 | BB+ | 0 |

| Mozambique | CCC+ | CCC+ | 0 | CCC+ | 0 |

| Namibia | BB | BB+ | 2 | BB | 1 |

| Netherlands | AAA | A | -5 | AA | -2 |

| New Zealand | AA+ | A+ | -3 | AA | -1 |

| Nicaragua | B− | BB | 4 | B+ | 2 |

| Niger | B− | B+ | 2 | B | 1 |

| Nigeria | B | B | 0 | B | 0 |

| Norway | AAA | AA | -2 | AA+ | -1 |

| Oman | BB− | BB− | 0 | BB− | 0 |

| Pakistan | B− | CCC+ | -1 | B− | 0 |

| Panama | BBB | BBB+ | 1 | BBB | 0 |

| Papua New Guinea | B | BB− | 2 | B+ | 1 |

| Paraguay | BB+ | BBB+ | 3 | BBB− | 1 |

| Peru | BBB+ | BBB+ | 0 | BBB+ | 0 |

| Philippines | BBB | BB | -3 | BBB− | -1 |

| Poland | A | A− | -1 | A− | -1 |

| Portugal | BBB | A+ | 4 | A− | 2 |

| Puerto Rico | D | BB+ | 11 | B− | 6 |

| Qatar | AA− | B− | -12 | BBB− | -6 |

| Republic of the Congo | CCC+ | B | 2 | B− | 1 |

| Romania | BBB− | A− | 3 | BBB+ | 2 |

| Russia | BBB | BBB+ | 2 | BBB | 1 |

| Rwanda | B+ | B | -1 | B | -1 |

| San Marino | BB+ | A− | 4 | BBB | 2 |

| Saudi Arabia | A+ | BB− | -8 | BBB | -4 |

| Senegal | BB− | BB | 2 | BB− | 1 |

| Serbia | BB+ | BBB+ | 3 | BBB− | 1 |

| Seychelles | B+ | BB− | 1 | BB− | 1 |

| Singapore | AAA | BBB+ | -7 | AA− | -3 |

| Slovakia | A | A | 0 | A | 0 |

| Slovenia | A | A | 1 | A | 1 |

| Solomon Islands | CCC+ | BBB | 8 | BB− | 4 |

| South Africa | BB | B | -3 | B+ | -2 |

| South Korea | AA | A | -3 | A+ | -2 |

| Spain | A− | A | 1 | A | 1 |

| Sri Lanka | CCC+ | BBB | 8 | BB− | 4 |

| St Vincent and the Grenadines | B− | BB− | 3 | B+ | 2 |

| Suriname | CCC− | BBB− | 9 | B+ | 5 |

| Swaziland | B− | BB− | 3 | B+ | 2 |

| Sweden | AAA | AA+ | -1 | AAA | 0 |

| Switzerland | AAA | AA | -2 | AA+ | -1 |

| Tajikistan | B− | BB+ | 5 | BB− | 3 |

| Tanzania | B | BB− | 2 | B+ | 1 |

| Thailand | BBB+ | BBB− | -2 | BBB | -1 |

| Togo | B | B | 1 | B | 1 |

| Trinidad and Tobago | BB | B− | -4 | B+ | -2 |

| Tunisia | B− | BB− | 4 | B | 2 |

| Turkey | B+ | BBB− | 4 | BB | 2 |

| Uganda | B | B− | -1 | B | 0 |

| Ukraine | B | BBB | 6 | BB | 3 |

| United Arab Emirates | AA | BB+ | -8 | A− | -4 |

| United Kingdom | AA− | A+ | -1 | AA− | 0 |

| USA | AAA | A− | -6 | AA− | -3 |

| Uruguay | BBB | A− | 2 | BBB+ | 1 |

| Uzbekistan | BB− | BBB− | 4 | BB | 2 |

| Venezuela | D | BBB | 13 | B | 7 |

| Vietnam | BB | BB | 0 | BB | 0 |

| Zambia | CC | B− | 4 | CCC | 2 |

Sustainabilty-adjusted credit ratings of selected countries

For a detailed analysis, download the ESG Sovereign Bond Report. Read more on the Global Sustainable Competitiveness Index

ESG Ratings vs. Conventional Ratings:

Download the Analysis:

ESG Sovereign Bonds

Sustainable Competitiveness vs. the WEF-Competitiveness Calssification:

Download the Anaysis: Sustainable Competitiveness Vs. WEF Competitiveness