Tesla & Co

Human-enhanced AI-forecasting

Changing seat: competitiveness-based forecasting the car industry

Until 2007, Nokia and Ericsson were dominating the mobile phone market, while Eastman Kodak was a global giant in film before the age of digital cameras. They are all gone – because they refused to read the signs on the wall. Cars are in a different category of commodities – mainly because a single unit costs a lot more than a film or a small electric device, and therefore turnover is much slower. Nevertheless, the global automotive industry is facing a significant turning point with the technological transition to a more efficient and cheaper technology: electric power trains. Traditional manufacturers have initially been slow with the electric vehicle transition, allowing new entrants reshape competitive dynamics.

The next five years will likely determine which companies successfully navigate this transition and which companies become casualties of technological and market disruption.

At the same time, we observe a growing disconnection between economic realities and valuation on the stock markets: Tesla, at least according to the financial markets, is currently worth more than double the 3 biggest car makers combined.

Using a mixture of conventional economic regression and deep-learning AI tools, we have conducted a forecasting model using historical car industry performance and production data, combined with brand power and consumer perceptions, model-line ups, and speed of adaption. Our analysis employs a sophisticated ensemble forecasting approach that combines multiple predictive methods:

- S-curve modelling

- Linear trend analysis with maturity-aware constraints

- Mean reversion models for market correction scenarios

- Conservative CAGR projections with industry-specific parameters

- Machine-learning data analysis tools

The model incorporates historic company performance indicators, company maturity stages and applies differentiated growth constraints based on each company’s position in the market lifecycle. Confidence levels reflect the degree of consensus among different forecasting methods.

This comprehensive forecasting model, analysing 21 major automotive companies, reveals a tale of divergent trajectories: the global car industry landscape is likely to look somewhat different by 2030.

Note: every model has limitations. Unforeseeable events are not included in or modelling. All models are assuming no further destabilisation of the geopolitical situation, and do not account for potential economic or supply-chain disruptions due to climate change

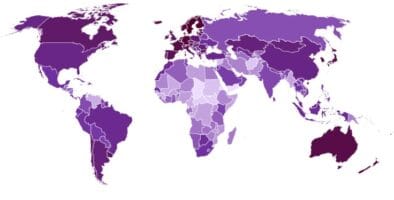

Vehicle production by country

China is set to further increase it’s share of total global vehicle production from currently somewhat over 30% to near 40%, in some models higher, catching the lion part of natural expected global output increase

American car makers are looking at the possibility of further decline in sales, revenues, and profitability

The European and Japanese car industry output is remaining stable with small changes depending on the brand, while Korean manufacturers are expected to see limited growth.

China: Coordinated industrial policy, infrastructure investment, and export financing have created a supportive ecosystem for automotive manufacturers that is bearing fruit: China’s vertically integrated approach—from lithium processing to battery manufacturing to final assembly—lead to cost advantages and supply chain resilience that is difficult to replicate. In addition, China’s domestic market provides the scale needed to achieve manufacturing efficiencies while serving as a testing ground for new technologies before global expansion.

US: Slow adoption of electric technology (except for Tesla until circa 2019) in the US has led to competitive disadvantages as global demand shifts toward electrification. Economic contraction, the science-adverse environment and supply chain dependencies/uncertainties are further impacting automotive demand and production capacity utilisation.

European production shows modest but steady growth, thanks to premium brands, providing a certain level of pricing power and margin protection against low-cost competition, while rapid EV infrastructure deployment and purchase incentives support domestic production and export competitiveness.

Japan & Korea: In Japan, the hybrid technology leadership provides a bridge during the EV transition while maintaining manufacturing competitiveness. Hyundai and Kia’s aggressive EV platform development and manufacturing investment positions South Korea well for the electric future. Both countries depend on export markets for growth opportunities as domestic markets mature.

India’s manufacturing rise is expected to continue, with sustained growth in domestic production and potentially export manufacturing. Brazil is expected to grow as a regional hub for South American markets with both domestic and export production. Assembly capabilities (and potentially future domestic development) in South-East Asia will rise, especially in Viet Nam and Thailand.

Vehicle sales by company

The modelling predicts declining sales for established US companies, in line with economic contraction and in combination with the longstanding inability/unwillingness to adapt the product line-up for export markets (in light of the pace of economic destruction, these numbers might still turn out overly optimistic). European car producers are able mostly able to keep their sales levels with marginal growth and decline changes based on different levels of brand power and technology adaption. Korean carmaker are expected to slightly improve. Chinese companies are expected to capture the largest share of growth. The model applied is based on data from a limited number of Chinese companies, representing both established and new entrance corporations (SAIC, Great Wall Motors, BYD, Nio, XPeng). Given the large number of Chinese car-makers and the fierce domestic competition between these companies, it would be unwise to take the number of individual Chinese companies at face value – this model cannot be used for picking winners amongst the newer Chinese EV makers. What is a given however, is that Chinese companies combined will see the highest growth.

Market capitalisation (share value)

The every-day value of a company on the stock exchanges is influenced by a large number of external signals (general market situation, market expectations, country-level economic data, short-term signals and market perception, geopolitical stability, politics) and is therefore impossible to forecast to any degree of reliability. The model applied therefore used historic baseline data and car market to gauge expected changes above or below the baseline (general market developments). Market cap is driven by sales, but also by the ability to extract sales premium due to brand power, technology, quality or cost-side production advantages.

Expected value versus market value

There is a difference between the market cap and a more logical expected or “fair” value. The market value is based on underlying performance, but also includes expectations of future developments and performance, as well as market and investor sentiment. Te expected value is calculated based on historical data for sales, revenues, and operational margins across all companies, adjusted for premium and branding factors.

The comparison of market and expected value is an indicator for the under/over-valuation of a company, and reveals some interesting insights. Tesla, obviously, is highly over-valueted, while traditional European companies tend to be under-valuated. Interestingly, expected future growth in Chinese EV manufacturers is already priced in their share values: they are overvalued already now, even in the case of explosive growth to 2030.

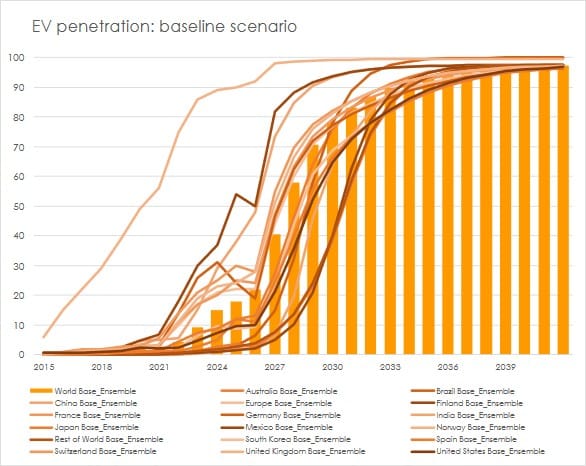

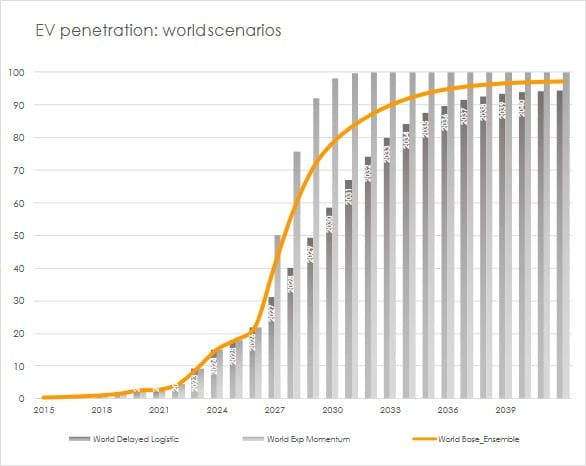

EV market penetration (share of sales)

Electric power trains have much higher energy efficiency compared to combustion engines: the theoretical max efficiency of a gasoline engine is roughly 35%, for electric motors that number is 100%. In practice, efficiency for internal combustion engine vehicles (ICE) is about 22% on the wheel, compared to 80-90% for EVs – a factor of 1:4. EVs therefore have much lower operating costs. In addition, EVs don’t need engine bonnets, and no transmission and gear box, translating in simpler and cheaper production. Less moving parts also mean less maintenance, and no need for oil changes.

The global EV market shows accelerating adoption, with worldwide penetration reaching 22% in 2024. Projections indicate potential market dominance somewhere between 2027-2035, driven by new model line-ups, declining battery costs, expanding charging infrastructure, and digital system integration. The accelerating transition reflects economic fundamentals including purchase cost parity achievement and significant maintenance cost advantages over internal combustion engines.

Nokia had a market share of 40% in 2008, when the first smartphone was announced. By 2025, Nokia ceased to exist as a company, and market penetration of smartphones reached nearly 100%. In light of the technological superiority, initial cost parity giving way to cost advantage, lower maintenance & operating cost, as well as technological adaption, most market transmission forecast seem rather conservative. This forecast is based on a weighted average of multiple growth models, taking into account cost development and technological advances. A market penetration of 80% by 2030 is not unrealistic.

A word about Tesla

Tesla’s stock value is currently double the value of the three biggest global carmakers combined. And nearly triple Tesla’s total accumulated revenues since Elon Musk bought the company.

If the valuation of companies were to follow a coherent logic, most shares would have significant different valuation. Tesla is currently valued at more than U$ 1.1 trillion (September, 2025). In 2024, Toyota sold more than 10 million cars, Tesla a little over 2 (and dropping significantly in 2025). Toyota’s revenues were 311 billion, Tesla’s 97 billion; Toyota’s profit 64 billion, Tesla’s 17. Yet, Tesla is valued more than 3 times higher than Toyota. Regression analysis of historic and current data across the automotive industry – cars sold, revenues, profit, brand value – allows for the calculation of an expected value for a car company. For Tesla, that would be 135 billion. In other words: Tesla is currently overvalued by roughly 900%.

Expectations, it is said, are driving valuation. Tesla is not only a car company; it is a tech company. According to the announcements of the executive there is huge expansion potential in robotaxis, humanoid robots. Investors seem to believe in that.

There’s a little problem with these expectations: Tesla’s competitors already have robotaxis on the road, in a few US cities, and many more in China. Tesla is late to the party. In addition – and for reasons not really clear – Tesla insists on operating its robotaxis on guidance system solemnly based on visual recognition, while the competition is using dual-vision guidance (visual and radar). Tesla robotaxis – if they ever hit the road – will have to stay at home in fogy conditions. They will be less safe and therefore less competitive against rivals that are already on the road, and might not be able to acquire accreditation due to safety concerns.

Factories around the World are already equipped with robots, with AI being integrated as we speak to increase efficiency and capabilities. There is no need for a robot to walk on two legs. They can move on 4 (or more) legs, on wheels, on tracks, or a combination of those – all more stable than a pair of legs. It feels like Metaverse – every teen can see it, but nobody dares to tell the boss: there is no market for humanoid robots.

Neither Robotaxis nor robots will generate the revenues that investors seem to expect, while the core business of car making is in freefall decline – Tesla has been asleep for the past 5 years while the rest of the industry took off. Tesla’s cars are now overpriced and technologically inferior to the competition.

Tesla is a mystery. But so are the financial markets.